MeridianLink Solutions

Digital lending & banking tools to empower your processes

Choose MeridianLink Digital Lending & Banking Solutions

Trusted for 25 years, MeridianLink® has confidently adapted to changes within the industry by providing unique, industry-first solutions.

End-To-End Platform

One powerful, digitally integrated platform that connects our customers to solutions spanning the entire digital lending journey.

Loan Origination System

Our SaaS cloud-based products provide financial institutions a stress-free loan origination process, so they can focus on providing a superior consumer experience.

Account Opening

Our account opening software improves consumer satisfaction with a fast and streamlined digital experience, allowing you to process more applications in less time.

Data & Reporting

Our consulting programs are based on a continuous improvement approach to help you meet your goals and improve the quality and effectiveness of your lending initiatives.

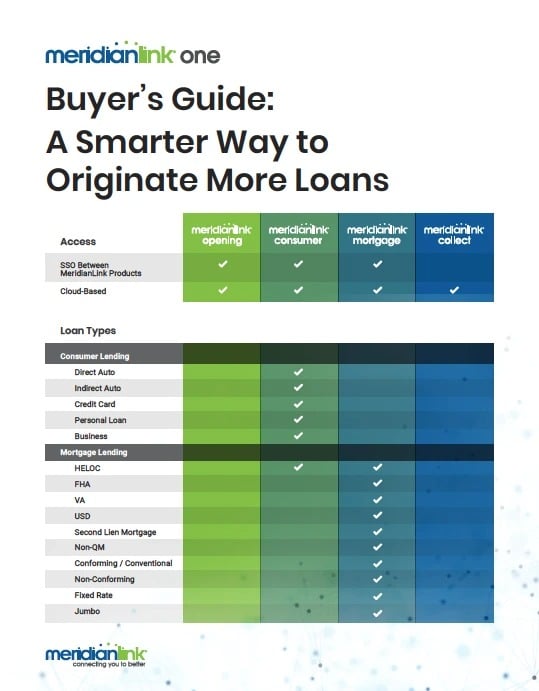

Download the Buyer’s Guide

Compare each MeridianLink solution by downloading our buyer’s guide. While each product and service is sold separately, many of the products and services can be connected and integrated within the MeridianLink® One platform.

Chat with our experts — learn how

you can develop lifelong financial management relationships to support a consumer’s entire financial journey.