The following post is part of a series of blogs written by MeridianLink® Partners who will be attending MeridianLink LIVE! To learn more about the event, click here.

Credit unions are increasingly recognizing the importance of embracing technology to stay competitive. While the impetus for change varies from credit union to credit union—some invest to stay relevant, others invest to grow, and others have made commitments to their boards—the impact of the change is always centered around improving the member experience.

Clutch is a Silicon Valley based technology company founded by the entrepreneurs Nicholas Hinrichsen and Chris Coleman. The two Stanford classmates met in 2011 and started a digital car retailing business, which they ultimately sold to Carvana® in 2017.

The two founders are passionate about the credit union space and are convinced that the tax-exempt nonprofits should dominate consumer lending. To support the movement, Nicholas and Chris partnered with North of 105 credit unions to build digital point-of-sale solutions for loan origination and deposit acquisition.

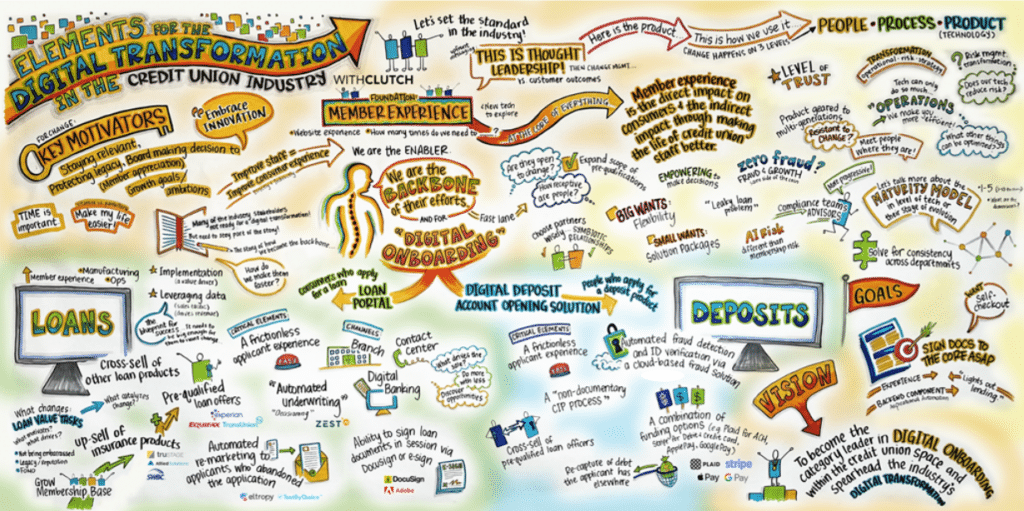

People, Processes and Technology

As a consumer-facing point-of-sale solution, the Clutch platform leverages all MeridianLink® API capabilities. Jointly, the two solutions provide a true fintech-like experience to credit union members and help ensure that credit unions remain their members’ first choice.

Digital transformation, however, is not just a technology investment. The three key elements for a successful transformation are people, processes, and technology:

- People: Clutch understands that people are at the heart of any successful transformation. The team is dedicated to empowering credit unions with the tools and support they need to thrive in the digital age. Part of the implementation process is a change management motion to get credit union team members excited about change. From personalized training to ongoing assistance, Clutch ensures that every member of the credit union feels confident and capable of utilizing our platform to its fullest potential.

- Processes: Streamlining processes is key to enhancing efficiency and reducing friction in member interactions. Leveraging MeridianLink’s API capabilities, Clutch revolutionizes the loan origination and account opening processes, making them seamless and hassle-free. Through automation and optimization, we help credit unions eliminate unnecessary steps and paperwork, allowing them to focus more on serving their members and less on administrative tasks. The main goal is to see past “but we’ve always done it this way” and reinvent processes to enable change.

- Product (Technology): Counterintuitively, technology is the easiest part. The combination of Clutch and MeridianLink has been in action for several years now and are in use by North of 70 credit unions. Thanks to the modern architecture of both platforms, implementing and configuring the technology can be quick (i.e., less than 4-6 weeks). By providing credit unions with the tools they need to offer quick, convenient, and personalized service, we help them build stronger relationships with their members and differentiate themselves in a crowded market.

In conclusion, the digital transformation in the credit union industry is happening at a rapid pace. The challenges we see credit unions run into today are not technology challenges anymore. Instead, to further accelerate their digital transformation efforts, credit unions need to entertain the idea of changing existing processes and finding ways to get their people onboard with them.

Clutch very much sees themselves as change agents in an industry that has done nothing but great things for consumers. Through a collaborative effort with credit unions and partner technology providers such as MeridianLink, we strongly believe that credit unions are on a great path to dominate consumer lending. We look forward to doing our part to achieve that goal.

If you want to learn more, feel free to reach out directly to our CEO and Co-Founder Nicholas Hinrichsen at nicholas@withclutch.com. We look forward to supporting you in your journey and feel honored to contribute to the credit union movement.