The materials available in this article are for informational purposes only and not for the purpose of providing legal advice. You should contact your own advisors with questions regarding the content herein. The opinions expressed in this article are the opinions of the individual author and may not reflect the opinions of MeridianLink, Inc.

Over the past several months during the pandemic, it has become apparent that the importance of investing in technology, both digitally and remotely, is vital to quickly and efficiently focus on the overall effectiveness of digital lending and account opening solutions for financial institutions.

This webinar is the first stop of our Summer Road Trip Webinar Series and our subject matter experts take you on a journey by covering the following key topics:

- Unifying the applicant experience for anyone who applies with your financial institution online

- Driving instant decisions to have a great user experience

- Automating backend processes that you may have been doing manually

- Sharing insights on fraud protection in a digitally driven world

Assessing your financial institution’s preparedness for all phases in digital account opening and lending.

Digital Account Opening and Lending Journey Webinar Transcription

Paul Forrest: Hello, and welcome to the MeridianLink Summer Road Trip webinar series. This is number one in a series of webinars. Today, we’re going to look at the digital account opening and digital lending journey from a digital perspective. This is a live presentation, so we do encourage you to type in questions on the question pane as we go through, we’re going to try to get to those and answer them. And there will be a Q and A session at the very end.

Paul: On the handout section, there is a digital account opening and lending journey assessment available for download. So you should be able to click on that and just download that document. All right. We do appreciate your participation, there’s only two polls that we’re going to ask during the presentation. Also, there will be a quick three question survey after you exit the webinar, so if we could get your participation, that’s helpful. We will have a $50 visa gift drawing as part of the presentation. So stay tuned in till the end and see if you hear your name called.

Paul: All right. My name is Paul Forrest, I am the VP of Sales Engineering at MeridianLink and co-hosting with me is Brandon Sisola. He’s the Product Manager of the LoansPQ loan origination system and XpressAccounts Division. Are you ready to get started Brandon?

Brandon Sisola: Absolutely. Thank you, Paul.

Brandon Sisola:

Good morning and good afternoon to everyone, depending on where you are in the country. Today, we’re really excited to kick off the Summer Road Trip webinars series, and we’re going to be starting our road trip here by talking about the digital journey. So here are the pit stops on our journey and on our road trip today. First thing we’re going to be talking about the shifting and the priority of digital lending and account opening, how it’s becoming a more and more important even outside of the COVID pandemic for you to have an effective digital lending and account opening solution.

Then our next stop will be merging the applicant experience. So really looking at how you can unify the experience for anyone that comes to apply with your institution online. After that, we will be talking about driving insightful instant decisions, which is a key portion of how you can have a great user experience for the applicant. We’ll be covering how you can go from zero to 100 by putting the pedal to the metal on digital automation, how you can really automate some of those backend processes that you’re doing manually today or have done in the past.

And then finally, something that is very, very present today that we need to talk about is how we can help you as an institution buckle up against fraud. If you don’t have someone in front of you, it’s a lot harder to verify and authenticate their identity. And so we want to make sure that you know, how you can best protect yourself against some fraudsters. So the first thing that we want to cover here is really reiterating the importance of digital in today’s environment. So if you’ve been on any of the virtual user forum sessions, or you’ve been on any of the webinars that Paul and I have done presentations on in the last year or so, we’ve really been hammering home, how important the digital account opening and lending process is.

And one number I want to stick out on this sheet for you is 42%. And what that number represents is the distribution of the population for the millennial and the Gen Z generations.

And so why is this important? Well today, the millennial generation is fully in the workforce. They’re contributing to the economy. They have jobs that they need to take and direct deposit that money into an account and Gen Z is split. Right now a portion of them are in the workfo

rce and then the other half or so are still in school, and so they’re going to be in the future they’re opening accounts, as they look to go to college. They’ll be looking to open up their first credit card.

And so those are the people that you really need to make sure that you can connect with both now and into the future to make sure that you get your foot in the door, so you can deepen that relationship into the future and prevent them from potentially going to one of the mega banks out there that are just omnipresent and have their marketing dollars to spend. So that’s really important to keep in mind as we look into the future, millennial and Gen Z.

But even looking at today, we have a strong preference for digital account opening versus somebody actually having to go into the branch. So looking at millennials, three quarters prefer digital, that’s not really a surprise. Millennials grew up in the era of Facebook being created and other things like that, the internet really coming into its own. And so they prefer that digital instant experience. But then when we look at the Gen Xers, two thirds prefer digital. So even the people that potentially are a little bit slower to adopt some of these new technologies are going to prefer a digital experience versus having to go in branch.

And really that just speaks to the culture of instant gratification. People want to have instant and digital can provide that. They don’t want to take time out of their day to have to go into a branch or especially today with COVID ongoing, having to go and potentially do a drive through transaction. They want digital. The other piece to keep in mind there is that despite institutions knowing that they have to offer digital, only around 25% of institutions can really provide a true end to end digital experience for account opening, and that’s not on this slide here, but you need to be in that 25% and realistically that 25% needs to grow. But if you’re in that 25%, you then have a competitive advantage in your area and you can compete with those larger institutions that are everywhere.

And you also want to make sure that when you have someone that’s trying to either sign up and create a membership, create an account, apply for a loan, they can do so successfully. Additional research found that three in five people who try to open an account digitally can do so successfully. So you want to make sure that you’re in those green smiley faces, and you’re not in the two of five that weren’t able to open an account because with Google, they’re going to be able to find another institution quickly and they may as, within five minutes have signed up for another institution and you lost your chance to get your foot in the door there.

So one thing to keep in mind as we’re going through this webinar is it’s really tailored around our digital assessment document. We want you to ask those hard questions of your digital offering today. If you can do this, if your system that you have can do it, and also if it can’t why you should look at switching. So the next point we’re going to be looking at is how we can merge the experience. So today applicants want a unified experience whether I’m applying for a checking account, an auto loan, a credit card, I’m going to want a single place that I can go and apply. I also want that to be familiar. I don’t want to have to go and have a different feeling application for all of those different application types.

So as we’re going through, there’s really one or two questions per slide that you should be asking yourself as I’m talking, and you can see them in bold here, and really use these as part of the assessment to give yourself that report card that we’re going to be asking you to provide at the end of this. So if you’re a credit union, one thing that you really should be focusing on here is, can you provide a unified experience for a loan and a membership application? That’s incredibly important. If I apply for a credit card today, which as a consumer, I think should be pretty easy. I don’t want to be followed up with two to three days later and asked to create a membership application, especially if I already put in all that information in my credit card, it’s great to have a merged experience.

Same thing, one of the big pushes across the entire industry right now, when we’re coming to the in branch side is around the universal teller experience. When I walk in as a consumer into your branch, I do not want to be handed off to another person. When I go to a teller or I go to a banker or a loan officer, I want them to be able to help me with all of the needs I have, even if they’re focused on consumer lending, I still want to be able to inquire about my mortgage, see the status, see where it’s at without being shuttled off to someone else.

As soon as that happens, that shuttling off, the hand off to someone else, not only do I feel like my time is potentially being wasted, but it also just erodes the trust in the institution a little bit where I feel like an ABC Credit Union representative should be able to help me with anything within ABC Credit Union. I don’t care about silos as a consumer and so we need to make sure that that experience is available both on a universal application on the digital side and also on in branch.

And then as we’re talking about the backend as well, while the focus is on the digital journey, you still have the engine of an LOS or an account opening system on the backend, and it really helps to have those things unified. And while we can talk for days about how the processes can be improved, if you have a single system on the backend from a lending perspective or an account opening perspective for your staff, it also has a big impact on the actual digital experience itself.

So an example of this, if I’m applying for a credit card and also opening up a checking account, and those are going into different backend systems, perhaps one system has the ability to immediately send me a text message upon the submission of the application, telling me, thank you for applying, we’ll get back to you in the next one to two days with additional information. If the other system or the checking account one, doesn’t have that capability, maybe it’s only email, I’m going to feel like there’s a disconnect here.

And then taking it a step further when there’s additional information that needs to be supplied. Maybe one system can provide a link through an email to be able to upload documents that I need to provide for the loan application process. But then for another one on that other checking account process, they don’t have that capability. And I actually have to go to an online portal, create an account, log in and then go and upload the documents. And now I’m confused because I don’t know if I’m using my online banking or if this is a completely separate login. So you can see how if you have one system that is consistent, it can really help with making that a frictionless experience for any application.

And then a final note here is even if you do have a single origination platform for all of your application types, you need to make sure that you are reducing the silos and the barriers within your institution and digital experience is driving what you’re creating as far as the marketing, and also any communication methods such as the text or the email that’s going out as part of the application process. A lot of the times what we’ll see is there’s a deposit count team, and then there’s the lending team, and they’ll set up their own different communication styles, their own communication frequencies, and with that, you’ll get a disparate experience even though you have the same technology on the backend. So make sure you’re bridging that gap and kind of deconstructing that barrier between the different departments, but to provide a cohesive experience regardless of what someone’s applying for.

So the next step, and what we just did from a journey perspective is as a applicant, I went online. I selected that I want to apply for a checking account for example. I put in my information and I clicked submit. So now you need to have that backend engine well refined to be able to drive your instant decisions. That is going to be one of the biggest areas that you can increase customer satisfaction. Increasing the customer satisfaction by increasing the amount of applications that are being instant decisioned.

And if you can just take a look at what percentage you are doing today from an instant decision standpoint, let’s say that you do 50% manual approval, or if you’re doing 50% manual approval, maybe you can do a bit more analysis on that cohort and say, what if we take five to 10% of that 50% and bake it into the instant decisioning or right there that is going to greatly increase the chance that you’re going to capture that applicant as a member or a customer of your institution, which then allows you again to get the foot in the door.

So make sure you’re not being overly conservative with your instant decisions. And we understand during these times with COVID, it’s definitely difficult to rely heavily on instant decisions with all of the impacts on the credit reports, but with the MeridianLink, we just announced last week, the cares attributes, where we can help you automatically identify any trade lines that have been impacted by COVID, things that have been deferred payments, if people have gone into forbearance, et cetera, and prevent those instant approvals. So if you haven’t heard about that, we made a forum post on it, highly recommend checking that out, and the support team can also get you set up with it immediately.

And then finally, once we have that decision, so I’m an applicant. And I put in my information, I received an instant decision, which I’m already happy with. Now what’s my next step? Five to six years ago, it would be thank you for applying. You’ve been approved. Now, please come into the branch in the next two to three days and come and finish the documents and we’ll get this wrapped up. Well, I don’t want to do that as a consumer. Again, it’s all instant gratification.

So what I would like to see is something like the in-session signing. So I get the approval. I’m on my phone as I’m doing this and I get the documents, I can review the documents while on the phone, I can provide the signature by signing my finger. I click approve. I click submit on that application and I no longer have to come in branch for the document signing piece. Now, this has taken probably three to four minutes for me to do all of this as part of the application, I am very happy overall with the experience so far.

And then the next portion that really can power up what you’re doing with the digital journey is providing more of that personalized approach for the borrower. So historically cross sells and cross qualification, increasing the share of wallet has been relegated to an action that people have to do, and you have to have good underwriters or good processors or loan officers to do this. A lot of the times, they’re just going to do the bare minimum to get the loans that they have in front of them processed.

So what you can do is instead use a system that has an effective cross selling tool embedded within it. And so you need to make sure that you have something that can look at your lending policy, reference that as an application comes through and provide intelligent cross sell offers during the process. We are in an attention starved society where there’s a million things going on in people’s lives at any given moment. At this time, when someone is applying with your institution, that’s the time they’re fully focused on the loan application or the deposit application with your institution.

If you try to follow up in two, three days, two weeks, three months, there’s a chance that they may see that email that has a cross call offer, but their attention is not focused on it. And so the best time you have is when they’re fully focused on your institution to provide some of those opportunities, to provide the option of, we see you have an auto trade line. We can actually refinance that and save you $50 a month for $600 in savings annually. And that’s something that can immediately deepen that relationship that you have and lessen their chance of going to another institution to get some of their financial services.

And so after that decisioning portion, what’s next? This is an area that really until recently has not been innovated on much. MeridianLink has had a focus on this in the last six months, and we’ve provided some new functionality that allow for automation here on things that were previously completely manual processes. So the two aspects I’m talking about here are core booking and disbursement or funding. So historically, what will happen is I apply, I get the instant decision. I can do the in-session signing, but potentially I still have to go in and provide additional information in branch, or I just have to wait a week for a processor to actually get to it on the backend, book it over to the core system and finish the disbursement process.

Well, with the increases in technology and what we can provide as part of the AP and LoansPQ solution, for a personal loan or a credit card, these steps can be fully automated as well. So rather than having someone have to go and actually book that core, or actually go in and fill the disbursement information, let’s say I applied for a personal loan. If I already have an account with the institution, we can automatically book over that new trade line into the core, and then automatically disperse the funds for that product into my existing account. Does not take any time whatsoever on the backend and it also provides that instant gratification that the consumer wants. And rather than saying, you’ll receive your funds in seven to 14 days, we can now say the funds will be in your account tomorrow. That’s a powerful statement.

And then the last thing, really the bookend of automation here is for both the front end of the process and then also the backend, are you able to have an integration with your home baking vendors? So if you have the account created, if you’re already able to select how you’re going to fund a new checking account, are you able to launch that home baking vendor immediately and pre-fill the information so they don’t have to reenter info? If not, that’s something that you really should look into. And then the same thing for marketing outreach for cross-sales, pre-qualifications and the like on the loan side.

And then the final aspect here before I turn it over to Paul is buckling up against fraud. Fraudsters are becoming much more sophisticated in how they are trying to dupe institutions out of money. So what I mean by that is a lot of the times in the past, we will see identity theft and that still happens today. However, fraudsters are starting to do new methods, things like synthetic fraud, where they’re creating fake identities, providing a fake pass for that person to apply for a bunch of loans in a short amount of time, receive disbursements of those loans and then that person who never existed now officially ceases to exist but the fraudster is now up hundreds of thousands of dollars.

So as fraud is changing, things like out of all questions, which are not the best experience, let’s be honest for an applicant are being phased out in favor of not only newer and less friction inducing, but also just faster authentication methods, things like device authentication. So you really need to ask, what can you do? Does your vendor, as your POS allow for things like device authentication and if not when will it, because if they don’t there should be very soon in the future.

So what we want to do here is I just went a little bit more into detail on some of the aspects of the digital assessment. And I highly recommend you look at the handout, that’s in the webinar here and give yourself a quick assessment. We’re going to be running a poll here to see what you grade your digital journey as, and it’s okay. We want you to be honest because we want to help you and it’s going to be very similar to a report card where you’re going to have an A, you’re going to have potential F grade. And if that’s the case, we can help you. Anywhere in between there’s still areas that you can improve.

And that’s where MeridianLink can help you on this Summer Road Trip to improve digital, especially during this time where COVID is really pushing things to be more digital than ever. And so while the poles up here, I am going to hand it over to Paul. Paul will be showing a little bit more about some more of the specific aspects of the digital journey and taking us through a demo of that as well. But Paul, it’s all yours.

Paul Forrest:

Terrific. Thank you very much for that helpful information. So I’m just taking a look at this poll. Hopefully everyone can quickly participate. It looks like we almost have 50% of individuals participating, so that’s great. We do appreciate it. I’m going to go ahead and close that poll right now, close. And now we want to go through the practical application. So what the digital experience with MeridianLink application portal would look like, how it’s going to afford your applicants, customers, your members, the best world class experience, and allow them to quickly and easily put through an application and more importantly, receive decisioning and potentially automatically onboard and automatically facilitate those applications.

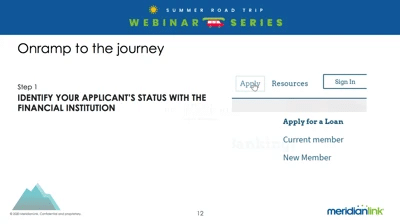

I’m going to come through here. First thing that you need to do, and this is typically handled on the website of the financial institution is to identify your applicant’s status. Too often, I go to somebody’s website and it says, click here to apply. And then there’s a very generic site that says, what are you looking to apply for? Right here we recommend next to each page, so you should have a page that talks about credit cards. You should have a page that talks about vehicles. On your deposit products you should have a page that’s talking about your savings and checking. So right there, there should be an apply button.

Now, this one here that I’m using is credit union specific, but for a bank it would be very similar. First thing you need to do is have them self-identify. Okay. We want to apply for a credit card. Are we a current member or are we a new member? Okay? With that current members or current customers should be directed to a login for your online banking SSO. So right here, they’re going to authenticate. This is going to reduce fraud. It’s also going to reduce keystrokes. So one of the most important things about a successful online journey is to make it quick and simple for the applicant. So if you already know who this individual is, if your core system, if your home banking system has information, we should leverage that information and have it pre-populate into the new application. All right. Single sign on one of the most effective ways of doing that. All right?

Next thing here is let’s say that they are a new member. Brandon alluded to this for credit unions a little bit earlier. We have an available what we call a combo application. So what it does is it stitches together the consumer loan application with a membership application. So from the member experience, it’s one still very simple application. It’s really easy to get through it. They don’t have to reenter. Right now, even if you send them out a link to apply for membership, they’re going to have to reenter information in other systems. With MeridianLink one quick application, five to six minutes they’re able to input the application for the consumer loan product, select a couple of options on eligibility and what accounts they want to open and then get right to the account opening CIP questions, to be able to auto account create.

Now for banks, you need to launch that directly into the application of choice. Again, if you’re on a credit card page, don’t have them go to a generic page and say, what loan do you want to apply for? Take them directly to the credit card application and use one of two available data pre-fill options outside of single sign on. Option number one is a mobile phone pre-fill. So here’s a couple screenshots. Step one right here, it’s going to ask you for your mobile phone number. So you’re going to put in your mobile phone number, it’s going to text a code to that mobile phone. Okay? As soon as that happens, of course, it comes up and says, enter your code. So once I confirm the code, then it goes a step further. We want to make sure we’ve got the right individual. So it asks for their zip code and their last four of their social.

So that’s enough information to identify the individual and to go over to their mobile phone carrier to do a query and to be able to fully pre-populate the application, right from that data from the mobile phone carrier. So very quick, very simple, very much digital forward thinking process. Option number two is the ability to take a picture of the back of a driver’s license. So hopefully everyone’s aware that you’ve got a barcode right here on the back of your DL. So as long as you’re on a mobile device, a mobile phone or a tablet, you’re going to take a picture of the back of the DL. It’s going to parse out first name, last name, date of birth, address information and ID information. Some states are a little bit different on what they provide, but it’s really going to get that core data set that’s going to allow them to quickly submit that application and receive an instant decision and potentially instant fulfillment depending on the app type.

So we’re going to take a look at the applicant experience. So what does that journey look like? I know I’m springing this on you, but if any of you have a mobile phone handy, this is a QR code. And if you want to take a look at the application, how it renders within your phone device, you should be able to bring up your … Excuse me, if it’s an iPhone, just bring down the camera, aim it, and it’s going to say, do you want to open this page? A newer Android will do something very similar. All right?

So once you open up that page, at least how I have it set up right now, you’re going to be seeing something that looks like this. For those of you that didn’t join along, of course, this is fully mobile responsive. So if you’re on a phone, it’s going to look something like this. It is designed for all sorts of devices, a mobile phone, a tablet, a desktop, a laptop, it’s going to render. This is the mobile phone pre-fill as I mentioned. So I could put in my phone number and select pre-fill. I’m going to go with option number two, and that’s going to be to take a picture of the back of my driver’s license. So I’m going to tap right here and I’ll just let you know, if you try to put in your mobile phone number, that is a test version of instant touch and you probably not going to get any data out of it. I apologize, but it is a test version.

All right. So what I’m going to do is I’m going to take a picture of the back of my driver’s license, let’s call it, batching Marisol test case. And it’s going to, in real time, this is a live option. I’ve taken the picture or I’ve used a picture that I would have had. It automatically parses that out and then pre-populates that right here into the credit card application. This application process is three simple steps. We really have a benchmark of four minutes. We want this to be a really quick journey, everyone wants to get to their destination. In this case on an instant approval, the destination’s going to be docu signing in my credit card agreement and then automatically onboarding this to the credit card issuer, so that’s in process.

The bank or credit union is not going to have to touch it other than doing some auditing and making sure everything looks good on the backend. I’m going to come down here and fill out any bits of information that are not included in the driver’s license. And I will mention some of these are included within the mobile phone and of course, with the SSO from online banking. So depending on which option, more of this is going to be filled out. How would I like to be contacted? Let’s just say, it’s going to be mobile phone. I’m going to click here.

All right. So I’m going to put in my information here. And of course, if I am on a mobile device, it will leverage the iOS or the Android system to pre-populate this information. It’s going to say, which email would you like to use? Which phone number would you like to use. Again, making this a very simple process for the applicants. Now, a nice available feature, especially since we’re recommending automatically onboarding and porting this directly into your core. You want to make sure that you’ve got a good USPS mailing address, so you don’t want any bad data going into your core.

So you can look here. We do have an available USPS address verification system. It is highlighting in real time that there’s something wrong with this address. Okay? I’m sure many of you noticed that I deleted this, but now I’m going to put it back in, suite 100. Okay? And I’m going to hit tab. And in real time, that changed suite to STE and then it took the zip and then added in the plus four. So before anything hits your core, you’ve got a good valid bulk mailing USPS address. Occupancy status. How long have I been at this location? Now, this is up to the financial institution. I’ve got mine set for two years of residency. So under two years, it’s going to ask for and require previous address. If I’ve been at that location for longer than it’s going to automatically hide that, again making it a simpler application process.

We do have an option right here for a mailing address or PO Box. Now, this could be suppressed. There’s a lot of data here that depending on the institution’s preference, we can hide this and make it even a simpler application. So this is my driver’s license. Everything is fully pre-populated. I’m going to come down here and enter in my gross monthly income. I can add additional income sources. So again, you want to make sure you have a complete picture of the financial well-being of this applicant. Right here if this other income is tax exempt, we can gross that up for fair lending. All right?

Excellent. I’m going to remove that. Now here’s my employment status. You can see we have various options here that I could select. We do support different military options. We support different self-employed owner options. I’m just going to come here and say, I’m employed, Product Manager of MeridianLink. Just like with residency, if I’ve been employed for less than a certain time, it’s going to ask for and require previous. Let’s just say I’ve been here for 15 years and six months. Right here in the application process, this is one of four methods that we’re going to give you to collect additional information from this applicant. Okay?

So if I want to come through here and say, well, let’s get a copy of the front of my driver’s license. Boom. There I am there. I’m going to say driver’s license front. As I mentioned, this is one option. I’m going to go through the other options. We really want to make it automated and make it very simple for your individuals to supply you with additional data. Also, we want to make it so that the institution doesn’t have to reach out and they don’t have to take action. We’re going to automatically look at the application and where necessary we’re going to be able to ask for proof of income, verification of employment, for instance my driver’s license.

Right here, I could add in an additional applicant. Now, one thing to mention that is fully unique with application portal is right here all of the language, employment duration, employer, you can change any of that. So if you want this to say occupancy, occupation, that’s the word I’m looking for, this would say occupation and not profession job title. Okay? So this is fully configurable. I’ve changed the branding. So it looks and feels like the MeridianLink corporate colors, but this was fully customizable. All right? I’m not going to add in my spouse, so I’m going to come here and continue.

So that brings me right here to step two, very simple. Step one, tell us about yourself. And using one of the three methodologies for pre-population that should be very quick and efficient. Step two is review. Make sure I haven’t miss keyed anything. Make sure this is right. And right here, I have user defined fields. We call them custom questions. So if there’s any additional information that you want to ask about this applicant, how’d you hear about us? How would you like to sign your loan documents? Hopefully everyone’s going with e-sign, but these are customizable. These aren’t standard questions. Will you allow us to send you text messages and call you on your mobile? TCPA? Got it right here. Yes, no.

This can change the communication options on the backend. Right down here we have actually different options for providing this applicant with disclosures. Option number one, and this is my terminology only. I think my marketing department probably groans when I say it, but I say, this is intrusive. I can’t go to the next page until I’ve actually popped this open and it’s going to go ahead and it’s going to render that disclosure right here and now I have to close it, so it does force a popup. This option, and again, my language only, non-intrusive. I just click a button to say, “Hey, I’ve read and agreed to your visa agreement and disclosures.”

Option three, I could have a text box where it just scrolls and then I could have a button right there. So depending on your compliance team, your marketing department, what works best for your institution, we can have the different disclosures here. Also, I could request an email with the links and get those sent right over to me. All right? So that is an available option. So right here, when I agree, the first thing we’re going to do like Brandon mentioned, fraud is really high on our radar and we’re making sure that we’re leveraging all tools available to reduce the risk for the institutions.

First thing we’re going to do is we’re going to look at a pool of all MeridianLink users and say, has anyone flagged this social security number as potentially fraudulent? So has any other MeridianLink user and we have a very large installed base, have they identified 00001 as problematic or potentially fraudulent? If so, it’s up to the institution. Do you want an instant decline or just instant refer that application? If you instant refer it, then we can automatically communicate with that applicant and ask for some additional information.

List number two is going to be unique to your institution. So there is a maintainable database where you can upload any individuals that have calls loss. This list can look at social, probably the most well-used. It can look at phone number. It can look at email address. It can look at street address. So if there’s any individuals that have done any account abuse, if you’ve noticed trend in fraudulent applications where they’re using the same email or the same phone number, those can be flagged right up front and before we pull credit, those could be identified.

Number three, and going back to what Brandon had said, if you’re using a third party to pre-qualify individuals, right here this is going to do a search to see if this individual has been pre-qualified for this product and it would come up and it would give them a congratulations message. And that is fully trackable and reportable to the financial institution. So right here, I’ve got two card options that I could accept. So I’m going to get, let’s see right here, I’m going to get the platinum visa. It’s a little bit higher APR, but it’s platinum, so it must be better. That’s going to go through. Now, it’s going to render a in-session DocuSign.

So right here, it’s going to be able to come up and I’m going to be able to sign this credit card agreement. I’m going to be able to sign the application. Maybe you’re going to have them sign a receipt of disclosures. Before anyone from the FI has touched this application, we’re able to present documents to them. The applicant, if they were on their mobile phone, they would be able to actually bio-metrically sign with their finger, stylus on the phone or tablet. Right here I’m just using the electronic version of my signature.

Now I’m going to finish. Now using application portal, this can now automatically onboard this over to PSCU, FIS. We have various vendors that we can automatically push this new credit card product to. So again, from the financial standpoint, you can look at the backend. You can do a little bit of follow-up. You can check some information, do a quick audit, but this was going to be able to automatically onboard and automatically facilitate this credit card product to this individual. All right?

Now, one thing to note, I did mention there’s a couple of different ways of getting information from the applicant. I showed you one option, which works well, but they have to be prepared and let’s face it most people aren’t, the in-application, this right here is a post application option. So right here is an automated communication. We have three different methods available. This is an automated email obviously. This could have been an automated text and we do have a secured web messaging format that I’ll show you just in a second.

So right here is going to look at our dynamic workflow and it’s going to say, okay, based on this individual’s credit, based on their location, what do we need from this individual? So it’s dynamically going to create a list of items that are necessary and this is all fully customizable to the FI. I’m going to click here right within this email, there’s a call to action. Okay. So as a financial institution, you want copies of pay stamps. How are they going to get that to you?

Option one, click right here. This opens up a secured site, an https site. Everything is fully encrypted. It’s going to allow them to upload up to 15 documents right into the FI. This will be attached directly to that application and you’re going to get an alert saying that a applicant has done a non in branch upload. So let’s just go ahead and upload a document here. So let’s say I’m going to again, use my driver’s license, send document. Really quick, really simple. You can see, I can click it again. I can upload multiple documents. That’s going to alert the FI. The FI can go into the application. They can view this document and then they can do what is necessary.

Now I’m going to come back here and I do want to show, now this is a landing page right here. But I’m going to go through a new deposit account or for the credit unions in the audience, a new membership application. You know I hit the wrong link, sometimes I do that. All right. So I’m going to come down here, new member account. For a deposit products we can do personal business or others. I’m just going to do a deposit account, a new membership application, personal. I’m running a little bit low on time it looks like. So I’m going to try to get through here fairly quickly. All right. So coming through here, and of course my internet just got slow.

Paul Forrest:

This option down here, the check status option, this is another option where they can come through here and they’re able to put in some pieces of information and they’re going to be able to check any application status within the last 90 days. It doesn’t matter how the application got put into the system, is all they need to do, and I apologize, my internet has gotten slow for me. This is COVID and we’re all working from home. And I think it’s just slowing down my internet, but they’re able to put in their last name, their email address and their social. It’s going to use that information to go ahead and to do a query into the backend LOS system, now here it is right here.

So I’m going to say, apologize full force, and I will say that this never happened to me before, but yeah, that is … So I’m going to come in here and say Paul F. I’m going to put in my social and then I’m going to hit get status. All right? Again, that’s going to do a query. It’s going to look into the backend of the system. And it’s going to find any of those applications that are in with that financial institution within the last 90 days. The different things I’m able to do here is I’m able to check status. I’m able to use the secure web communication option and I’m able to upload any documents into the system. Oh, that’s great. All right.

So this one, I used a different email because I thought it would be faster. Let me just go here. Let’s get status on that one. And in the meantime, I’m going to pull over here and I’m going to run through a quick membership application. So right here, and again, this is all configurable. For a bank case would be identical other than the eligibility requirements obviously aren’t the same. So I’m going to come right through here. I’m going to select how I’m eligible. Here, I’ve got my required products, so I have to have a standard savings account. So I’m going to add that in there. I could add in a checking account; I’m going to add that there. You notice we do have user defined fields here at the account level. So if you want to ask about courtesy pay, overdraft, account alias, that is all fully configurable and that will flood over into your core. Okay? Continue.

Just like I had shown you before, you’re going to get two different options here for a new account. Option one is going to be the instant touch option, which is going to ask for the mobile phone number. And then it is going to go through and send a secure message. So you authenticate that individual does own that device. And then it does a couple of options here where it’s going to authenticate who they are. Again, zip code and last four of their social. This is what it looks like. Again, I apologize for the slow internet. Or option two, we can click right here and I’m going to take a picture of the back of my DL, and I’m just going to go through and fill out the additional information.

So you notice here, this is very much like the lending application. That’s another thing that Brandon had stressed, that unified experience, that process, that if I’ve applied at the financial institution before I know what to expect, I understand how long this process is, because this is how I joined for membership. This is how I put in my loan application. This is going to be unique. We also have options for first mortgage coming through on the same UI here. So all fairly simple. I’m going to go through.

User defined fields again. Do we want to have any POD or beneficiaries? Let’s say no. Do we have another applicant? No, let’s make this an individual account. This is optional. So it depends on your financial institution. Do you want to collect this information? Okay. So I’m going to continue here. All right. Next thing is the ability for this applicant to go ahead and fund this account. We have a couple different methods. PayPal, credit card, ACH, mail check, internal transfer. Let me tell you, sometimes I believe these are inversely listed here based on financial institution preference versus end user preference.

If I’m an end user, the simplest thing for me is going to be PayPal. Really quick, I put in my username, I put in my password, boom, transaction done. I don’t need to get my wallet. I don’t need a key in a lot of information. That is number one request. Number two, credit card. Okay. If I’m on my phone, my phone remembers my credit card. I’m just going to say, use this card, quick and easy. Transfer from other FI, ACH, we can automate that. Now, like I said, I have noticed a lot of financial institutions do that reverse. They love ACH, not great on credit cards, PayPal, not so much. We really want to think about making this journey really easy and simple in giving you the tools that are going to allow them to complete this really quick without having to grab a wallet.

I’m going to say mail and check because that’s easiest for me of course, on a demo. Again, I’m going to review everything, make sure it’s correct. How’d you hear about us? Say online search. Right here are a couple of different disclosures. Again, this is intrusive. So I’ve got my account agreement. I’ve got my privacy policy. Let’s call it right here that I’m going to go through. Actually it’s Google’s privacy, but okay, right here is the Patriot compliance. Just like with the loan app, it’s going to check a fraudulent list with all MeridianLink users. It’s going to check a has caused lost or high risk consumer list.

If it passes those it’s going to come through here and do an ID authentication. We have several different vendors. We bring the best of breed options out there to allow you to make sure you know this customer, know this member. They all do about the same thing, so there’s going to be four or five knowledge based questions. So I’m going to have to come down here and answer those. Now, it’s going to go through and do a deep review of the applicant data. Does name match? Does social match? Does the address match? So how certain are we that this person is who they say they are?

This does meet your Patriot Act compliance for know your member, know your customer. As long as they pass, the next thing we can do and this is optional of course, is we could look at a check abuse report. Qual file seems popular. We can do tele check. We can do deluxe detect. A lot of institutions are starting to look at credit variables to see how likely they are to do check abuse items. Now, right here what’s happened, this already went into the core system and this already created this person as your newest member. So this person would have an account number, would have a member number here. Now, as all as we need to do is have them electronically sign.

So they’re going to come down here and again, they can draw, and this is really hard to do. They can adopt that. They can go any additional signatures anywhere that they need to date initial. All of that’s going to be completed. Now, what’s going to happen, again if you’re doing the complete journey, if you want to go point A to point B, the important thing is, okay, now this person is in your core system, how are they going to get access to your online banking? We have an API that’s going to allow them to on this page right here. Your enrollment screen is going to pop up. All the information that we know about this applicant is already pre-populated in that enrollment window.

So again, to reiterate, you’ve got the application, you’ve got signed documents, you’ve authenticated this person through CIP. We’ve created the account inside the core, and now we’re giving options where they can quickly go in and complete the onboarding process for online banking. After that, we’re going to do this. We checked this person’s credit report and we see that they have a USA Federal Savings Bank vehicle loan. So we’re going to try to recapture that loan and see if they can refinance that at your institution, and we can show a monthly or life of loan savings right here.

We can pre-qualify them for a visa card, multiple cards. We could pre-qualify them for a new vehicle loan. So the ability to cross sell this individual, as part of this journey, boom, full end to end. And as Brandon mentioned, I just want to reiterate, for personal loans we could have already dispersed this and it could be in their account right now. Credit cards, it could be automatically in. So really the last thing for you to do, and I’m just getting ready to wrap up here, it looks like our time’s going out. I want some time for questions.

But now I could come in here, this is the credit card app that we just did. And with this very easy portal, now I could come through here and review everything, check my documents, make sure all my signatures look correct and make sure all my I’s are dotted and T’s are crossed, and the T’s I do mean my task list. So I made sure that this is done and I made sure this is done. I say, this is audit ready, and we are ready to go ahead and get this over to the applicant. All right. Now, couple things. One, we do have the winner of the gift card. I want to see if there’s any questions. Brandon, any questions that came up that looked like they would be applicable for everyone in the audience to hear?

Brandon: Yes. We have a few good ones here. So the first one I want to cover and I talked a little bit about the fraud prevention and how we’re continuing to integrate and Paul mentioned we’re enhancing that as well, is Experian CrossCore coming. And so an update on that. We are wrapping up the development and we are going to be releasing that, our target is in the September production release, and we want to do some beta testing next month in August. So that’s, exciting news. That’s coming soon.

Paul: Excellent.

Brandon: And then Paul, this may be a good one for you. So can the applicants volunteer or sign up for things like e-statements as part of application portal?

Paul: Oh, absolutely. So there is the ability to have any kind of, we call them add-ons to a deposit product or account. So things like e-statements, things like they want a visa debit card. Those could be indicated as a preference as part of the application and then core dependent, we do have the ability of pushing that over in setting up an appropriate preference record or sending something over that will trigger that within the core. Again, each core is a little bit unique on how they handle those add-ons, so that’s something that would have to be looked at. But definitely we can get the preference. Also, with that and I know I’m running a little bit late, but also with that, if they do want the preference, when they e-sign, that could include certain documents that pertain to that option. Okay?

Brandon: Thank you. A couple other ones that I definitely want to cover here. For PayPal and the credit card processing, is that available by default and how can I sign up? So if you’re an existing application portal, LoansPQ client, we’ll go ahead and contact your partner success manager. They can get you set up. Those options are available, but they are not enabled by default. For PayPal there’s a onboarding procedure we need to follow to make sure everything’s going to work from the get go.

Paul: Good point. All right.

Brandon: And then one additional one that I would like to cover here is which application types does AP have? And you mentioned this, Paul. We have the gamut of credit card, personal loan, auto loan, home equity, your deposit account. Yep. And you can see it visually here. Paul did it as I was talking. But then we also have application portal for mortgage, so that points to our lending QB mortgage LOS.

Paul: Absolutely. All right, well, let’s take a look at the last poll and hopefully I’m hanging everyone on with the suspense on the gift card. So let’s take a look at a quick poll here. I’m going to select here. This poll here is, would you like to have someone for MeridianLink … and I’m launching this right now, contact you to learn more about these products? So if there’s anything that you’ve seen that you want additional information on either the LoansPQ which is our consumer lending platform, Xpress accounts, which is our new membership platform, application portal, which is the online digital experience that I’ve gone through that is available for you.

Paul: So if you can go ahead and select those options, what seems like it would be something that you’d like to have information on. I’m going to let this run just a little bit here. And this is being recorded, hopefully I mentioned that at the beginning. So this is being recorded. We will provide a link so you can come here and listen to/view this webinar. Have different people see it if they were unable to attend. All right, let’s see what we’ve got here. So I’m just almost a 50%. I usually don’t like to get this going longer than a minute, but I do want to try to at least achieve 50%. So if we can just get a couple more people to say that you had a great time and that you want information about LoansPQ, then it’s a successful webinar for us.

Paul: So as we’re waiting for that, let’s see what everybody is hanging on for, and then I’m sure I’m going to lose everybody. So the winner of today’s $50 visa gift card, drum roll please, is Ms. Sarah Adams with Minnesota Valley, FCU. Miss Sarah, if you are there, and you know what, I didn’t ask how we’re going to get this card to her. So Ashley, how are we going to get this card to a … oh, we are going to reach out to you, Sarah. Sorry about that, she just … [inaudible 00:58:52]. So Sarah, we’ll reach out to you with instructions on how to claim your $50 visa gift card. And it looks like … oh, excellent. I’ve got just 50% individuals. I do appreciate that. So I’m going to go ahead and close this poll.

Paul: Now, as I mentioned, there will be a quick survey. So if you don’t mind spending just another three minutes with MeridianLink today, not even three minutes, it’s three questions. It’s going to take you 30 seconds. It does help us really define on what kind of depth we need to go for, how much you guys are getting out of these presentations and allow us to prepare presentations a little bit better in the future. So I’m going to close that poll. Anything you have in closing Brandon?

Brandon: Think that covers it all. I just want to thank everyone for attending the webinar today. I think it’s very important that we continue the conversation around the digital journey, and I hope that you got something valuable from this. And if you have any further questions, if you want to enable some of these features, if you’re interested in hearing about some of the functionality, don’t hesitate to reach out. If you’re a LoansPQ client already, to your partner success manager. If you’re a prospect looking at LoansPQ and application portal, contact us or reach out to your sales rep and we can get you that information you need.

Paul: Excellent. Everyone mask up, be safe and socially distance. Thanks all.