MeridianLink Consulting

Business consulting & analytics

Solving Your Most Complex Business Challenges

Financial institutions achieve their best results through business intelligence and process optimization. But how can your organization stay competitive without breaking the budget on an in-house team of experts? MeridianLink® Consulting is here to help.

Optimize Products & Performance

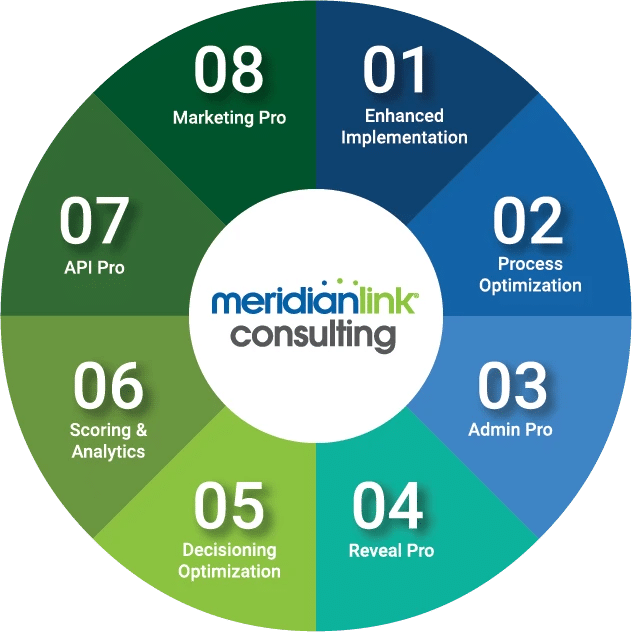

Choose from eight unique consulting services designed to help your staff achieve optimal efficiency and peak product performance.

01. Enhanced Implementation

Maximize origination process efficiencies and effectiveness within MeridianLink® Consumer, MeridianLink® DecisionLender®, and MeridianLink® Opening.

02. Process Optimization

Increase ROI by optimizing system configurations and workflows within MeridianLink Consumer, MeridianLink Opening, and MeridianLink® Portal.

03. Admin Pro

Access a team of experienced system admins for implementation, maintenance, and more within MeridianLink Consumer, MeridianLink DecisionLender, and MeridianLink Opening.

04. Reveal Pro

Improve performance, monitoring, and compliance by leveraging business intelligence for better analytics and reporting.

05. Decisioning Optimization

Increase origination volumes and better control credit risk by improving the operational efficiency of decisioning criteria.

06. Scoring & Analytics

Expand loan capacity with a custom scorecard to more accurately predict an applicant’s probability of default and credit risk.

07. API Pro

Strengthen connectivity between MeridianLink® products and in-house or third-party applications and services.

08. Marketing Pro

Identify growth opportunities and drive new strategies with consumer insights from MeridianLink® Engage.

The MeridianLink Advantage

The MeridianLink Consulting team has extensive experience optimizing systems and processes for banks, credit unions, and other financial services companies throughout North America. See how we can help your organization gain a competitive edge through a combination of thought leadership, expertise, support, and operational excellence.

Expertise & Support

We partner with organizations of all types and sizes to help solve their most complex business problems.

Operational Excellence

We optimize systems and processes to help each customer realize their MeridianLink products’ full potential based on their institution’s unique needs.

Thought Leadership

When it comes to innovation, we lead the way with up-to-date industry knowledge and best practices.

MeridianLink Consulting Resources

Fortera Credit Union Customer Story

Learn why Fortera activated four MeridianLink Consulting Services.

SPIRE Credit Union Customer Story

See how MeridianLink Consulting helped SPIRE fine-tune their processes.