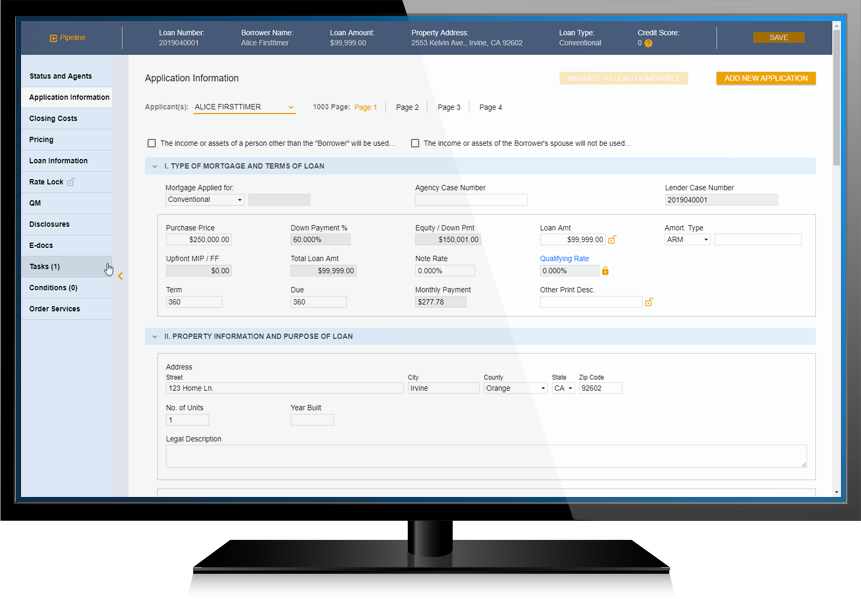

Cut origination costs and reduce cycle times by leveraging industry’s leading web-based mortgage loan origination platform.

Modernize the mortgage process with a highly configurable browser-based mortgage loan origination platform.

LendingQB's Open API connects to more than 300 integration products ranging from point-of-sale, compliance, e-closing, and more.

From 20 to 2000 loans per month, LendingQB's comprehensive web-services and configurability means lenders don't have to sacrifice their unique workflows.

LendingQB's PriceMyLoan Product Pricing Engine was built natively in the LOS and is considered to be a true Automated Underwriting System (AUS).

Live chat, phone support, and a knowledge base ensure that lenders never miss a beat. Highest rated in online help & help desk support by STRATMOR's Technology Insights Report.

LendingQB automates processes and creates consistency in day-to-day work to significantly reduce manual keystrokes. Being SaaS-driven means drastic cost and time savings for IT departments.

iServe Residential Lending

Inlanta Mortgage

3560 Hyland Ave, Suite #200

Costa Mesa, CA 92626

T: 866-417-5130