The following post is part of a series of blogs written by MeridianLink Partners who will be attending the MeridianLink LIVE! User Forum in May 2023. To learn more about the event, visit https://www.meridianlink.com/userforum.

Credit Unions and Digital Acquisition: David vs. Goliath

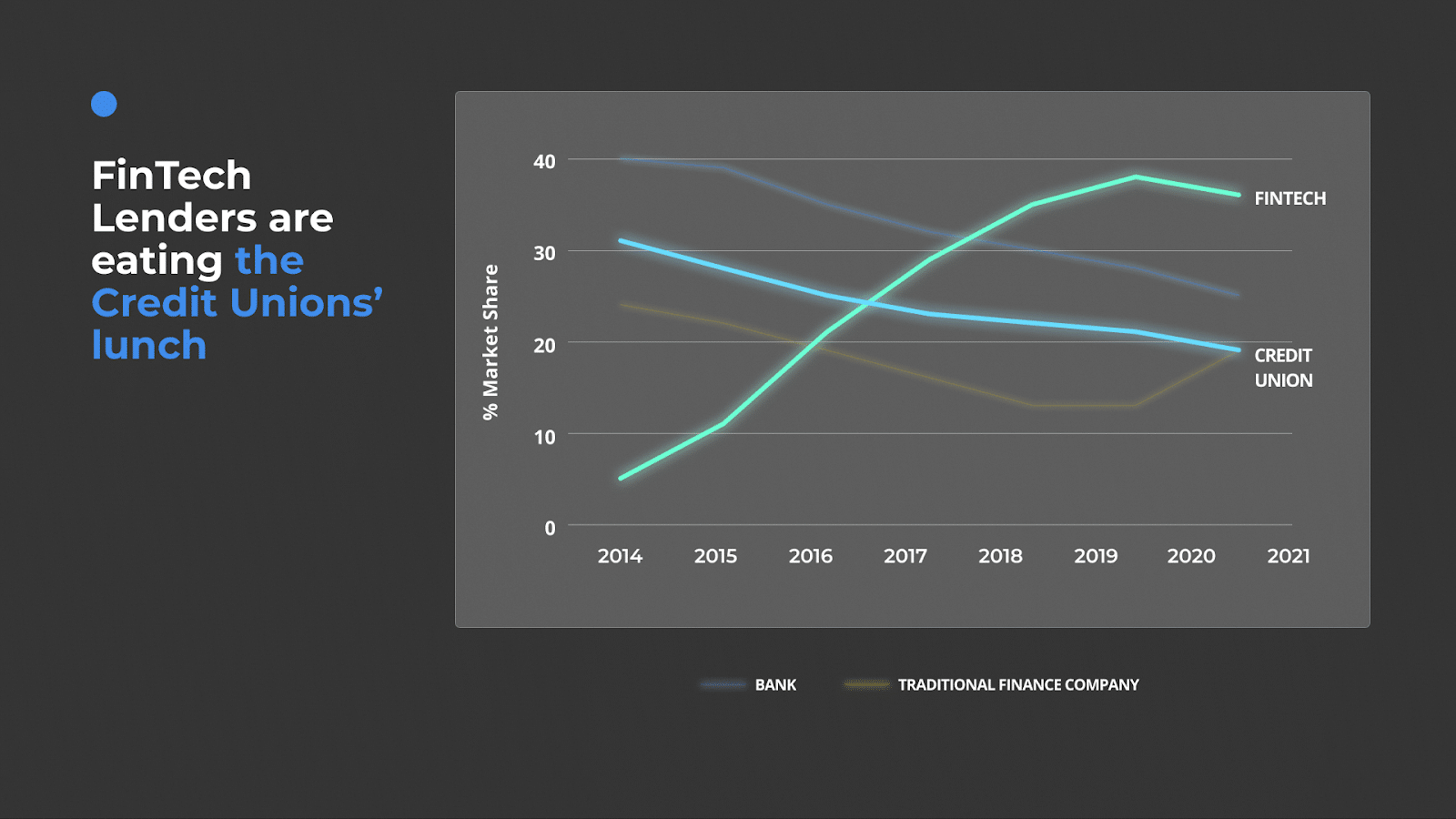

The financial industry is evolving to where digital acquisition is an essential need. Direct-to-consumer fintechs with billions of dollars in venture funding such as, on the deposit side, Chime, Brex, or Ramp and, on the lending side, Upstart, Upgrade, or SoFi, have turned into the most-dominant players in the fintech space.

To compete with the direct-to-consumer fintechs, Chase has increased its investments in technology and infrastructure to over $12 billion per year (i.e., $200 per active Chase customer).

Credit unions are facing a “digital handicap” that leads to a decline in new member acquisition and a decrease in engagement among existing members:

Source: TransUnion via CNBC.

The inconvenient truth is that credit unions are going to face an existential crisis and are at risk of becoming irrelevant. Most attempts we’ve seen of credit unions building software in-house put the respective institutions in an even more disadvantaged position for lack of compatibility and high maintenance cost. And several credit unions that seven years ago opposed technological progress, explaining that they’ve “always done it this way,” have been merged into bigger and more progressive organizations.

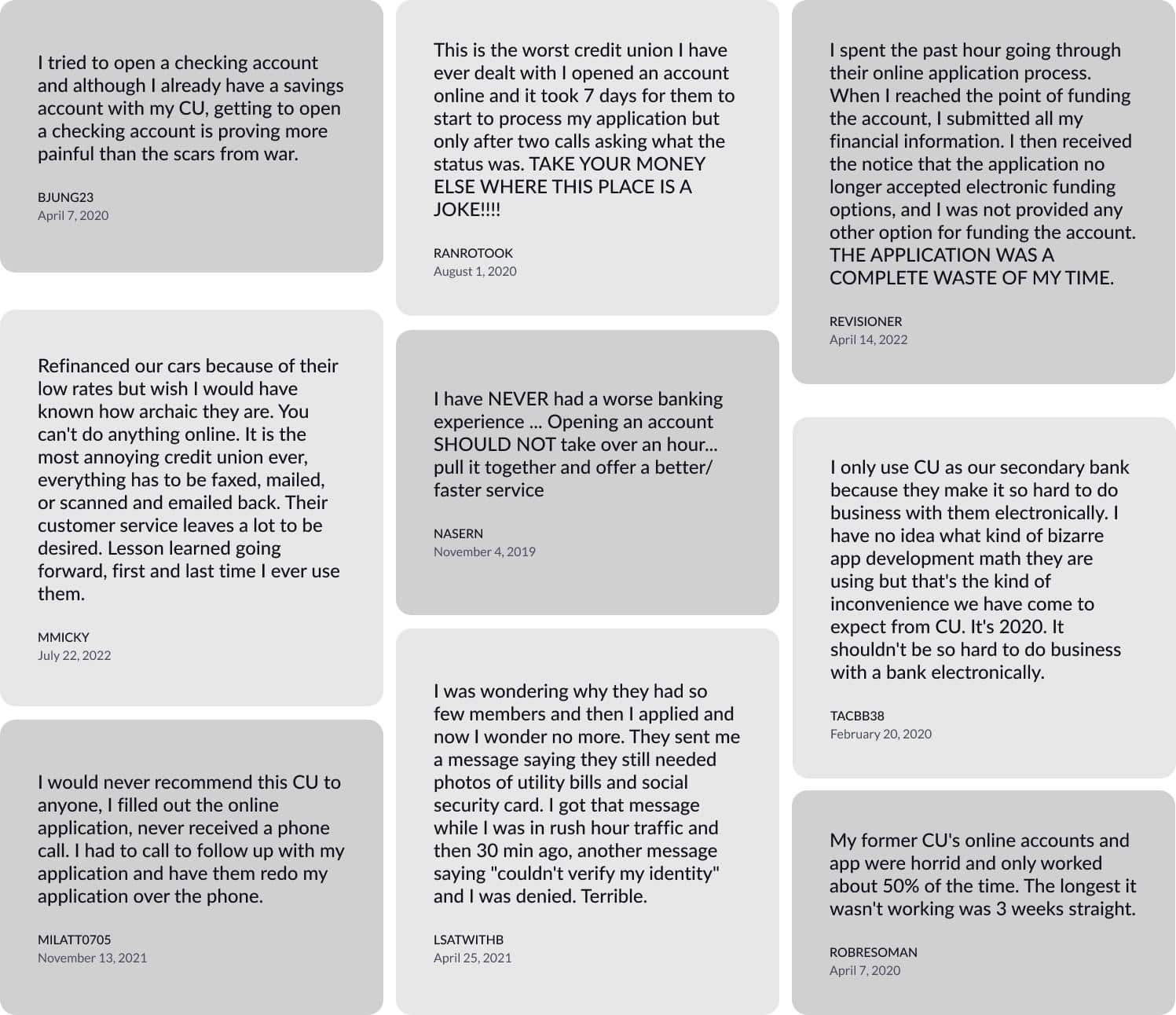

One look at Reddit reveals how a lot of consumers feel about the nonprofits’ digital offerings:

However, not all hope is lost. Credit unions have several advantages that they can tap into: a structural advantage due to their nonprofit and tax-exempt statuses, an ability to stand out due to their community focus, and an investment in personal relationships with their existing members. We are witnessing many credit unions cleverly leveraging their advantages by seeking relationships with technology partners who can deliver competitive experiences and who are committed to the movement.

We strongly believe credit unions have the opportunity to become significant players in the fintech space, and MeridianLink® Opening and MeridianLink® Consumer are extraordinarily powerful foundations to achieve that goal. With our laser focus on turning credit unions into fintechs, Clutch is uniquely positioned to leverage existing infrastructure and help credit unions succeed in their digital transformation.

Clutch Loan Application POS

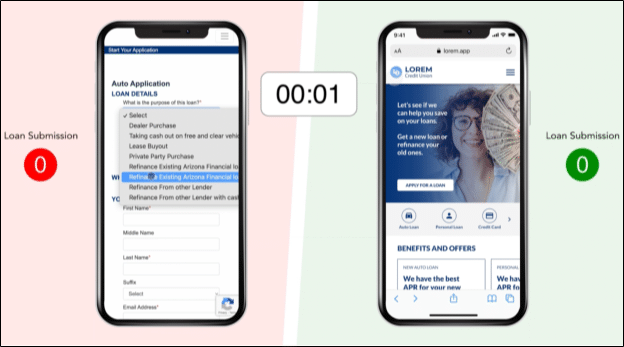

Clutch has shaken up the credit union industry with its frictionless loan application point-of-sale (POS) experience. The POS sits “atop” MeridianLink Consumer and provides credit unions with a premium digital lending experience.

There is, in fact, a lot of low-hanging fruit—as one Reddit user pointed out: “I spent the past hour going through [the credit union’s] online application process.” Not surprisingly, Clutch has demonstrated its ability to drive direct loan growth, boost profitability, increase share of wallet, and reduce the cost to produce a loan:

The side-by-side comparison above (click here to see for yourself) outlines the three things the Clutch platform does very well:

- Minimizes the Time to Offer (TTO): The Clutch portal shows applicants credit union loan offers in less than three clicks. To do so, Clutch leverages hundreds of third-party data sources that remove friction from the application process. As a result, pull-through increases and days-to-fund improves.

David Germann, CLO of Credit Union of America, attests to these drivers in the CU of America case study:

“You have moved the dial so much, we increased traffic conversion by 136% and decreased abandonment by 22.7%.”

- Becomes the World’s Most Helpful Loan Officer: The Clutch portal automatically analyzes the entirety of an applicant’s debt and credit circumstances and makes it easy to act on other opportunities. As a result, the credit union increases wallet share for every applicant.

Mia Lao, VP of consumer lending at Wings Financial, explains in the Wings Financial case study:

“North of 15% of our credit card applicants submit a refinance application. We’re already seeing the lift and we’re barely scratching the surface.” - Generates Non-Interest Income and Provides an E2E Digital Process: The Clutch portal automatically checks for eligibility of debt protection products and even allows applicants to sign their loan documents without ever talking to a loan officer. As a result, the credit union increases its non-interest income while providing a fintech-like user experience that drives look-to-book.

Caleb Cook, SVP consumer lending at Digital Federal Credit Union, would summarize their results in the following way:

“We increased look-to-book from 46% to 81% and decreased time-to-fund from 7 to 1.5 days on approved member auto refinance applications.”

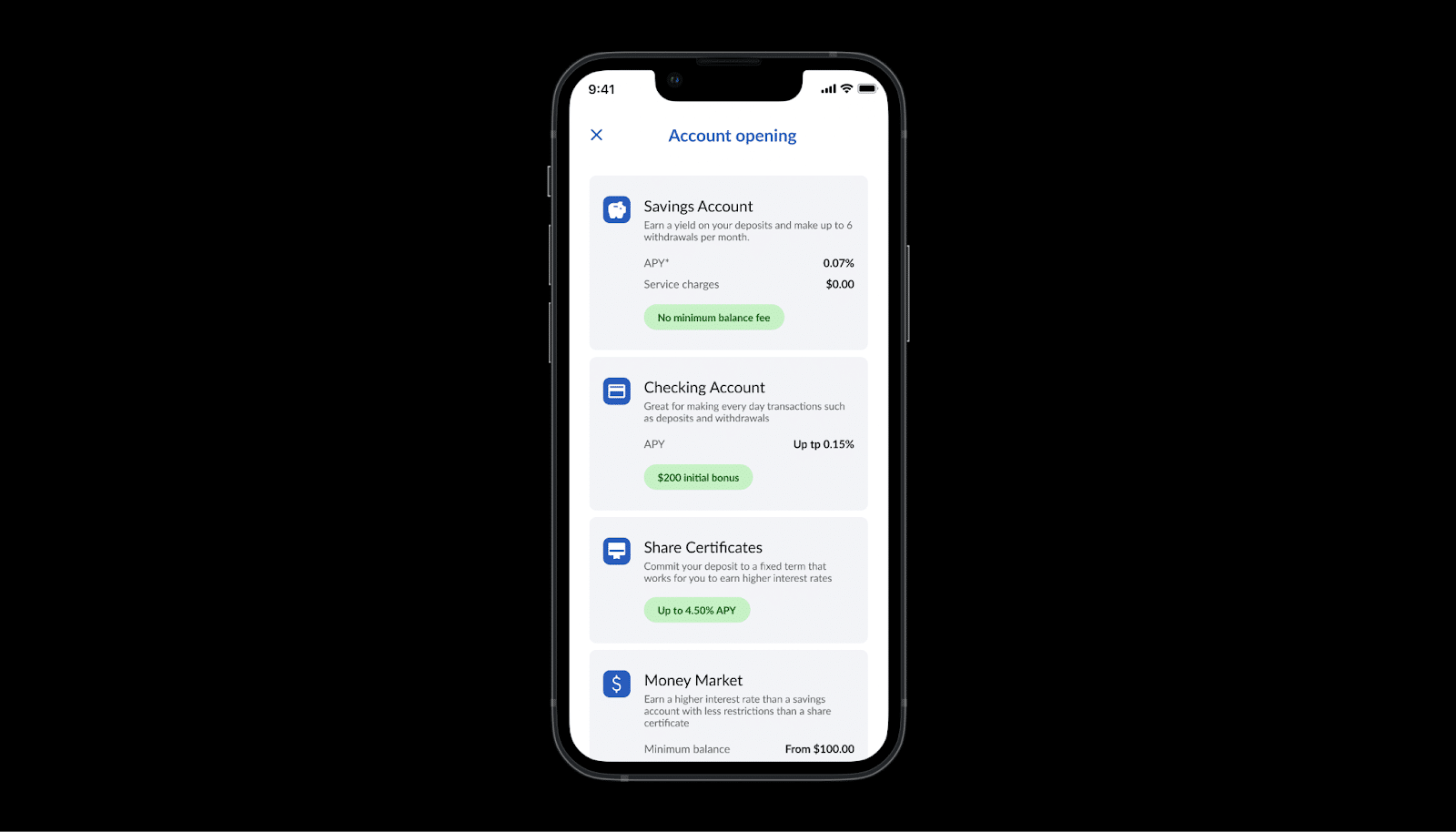

Clutch Account Opening POS

Clutch’s Digital Account Opening POS works with MeridianLink Opening to provide credit unions with a premium digital account opening experience. It does three things very well:

- Collects personal information from consumers: Consumer attention spans are decreasing. Clutch, therefore, prefills all pieces of information required to open an account and radically reduces the steps a consumer needs to take.

- Table stakes I.D. verification and account funding options: MeridianLink offers a range of I.D. verification and fraud detection services. To maximize consumer engagement, Clutch supports several funding options including bank transfer, debit and credit card, and automated payroll deduction.

- Cross-sells additional products: Once the account is opened, Clutch immediately aims to “become the World’s Most Helpful Loan Officer,” cross-selling loan products and upselling ancillary products to generate non-interest revenue.

Thanks for 100 Votes of Confidence

We feel humbled by the influx of progressive leaders to the credit union movement and owe MeridianLink and our clients a huge “thank you!” for their votes of confidence:

Your credit union is currently thinking through its digital transformation. Get in touch via email at contact@withclutch.com and we will help you properly prioritize your projects to successfully turn your credit union into a fintech.